Lactose Intolerance: Canadian dairy supply management, the Trans-Pacific Partnership, and Lessons from Australia

By Matthew Jerke

Canada, with a relatively small but considerably open economy, relies heavily on international trade for sustainable prosperity. The current government has made very clear its intentions to establish new, comprehensive agreements and deepen ties with current partners. Yet, in a world of falling trade barriers and rapidly rising dairy demand, Canada’s dairy supply management system stands out as a notable exception to their liberalisation agenda.[1]

A recent study by the Organisation for Economic Cooperation and Development (OECD) estimated that dairy price supports in Canada cost its consumers an average of CAD$2.6 billion per year in the decade leading up to 2011.[2] Moreover, the management of dairy supply means Canadian producers are missing out on one of the world’s fastest growing export sectors. In the OECD’s most recent agricultural commodity projection, global butter demand is expected to grow by 21 percent from 2013-2022, while over the same period cheese and whole milk are projected to grow by 11 and 13 percent, respectively.[3]

This paper analyses how Canada’s supply management regime disproportionately effects low-income Canadian consumers, removes its farmers from the international marketplace, and weakens its international negotiating position, while presenting an alternative policy path based on lessons learned from the Australian liberalisation experience. It argues further that the Trans-Pacific Partnership (TPP) negotiations present an opportune moment to enact a staged reform. Such action would come at a low political cost to the current government and, if carefully orchestrated, could seize opportunity for Canada’s farmers in the consistently growing dairy export market.

What is dairy supply management in Canada?

Supply management in the Canadian dairy sector is a government administered scheme to maintain farm incomes and manage market risk faced by dairy farmers.[4] However, it does so at a cost to consumers by generating higher-than-market prices which are based on supply rather than demand. In a nutshell, the system rests on three pillars: (1) the administration of prices, (2) binding production quotas to control supply, and (3) import barriers to shield off international competition.[5] Canadian dairy supply management is only effective with heavy government involvement to enforce production quotas and restrict imports through high tariffs.

The first two pillars are interconnected in that the administered prices paid to dairy farmers, which are calculated by the average production cost of raw milk, are achieved through binding marketing quotas set by provincial milk marketing boards.[6] Without a quota to control how much milk is being produced, overproduction would send prices tumbling below the cost of production target. The third pillar, exorbitantly high tariffs (for example, 246 percent for cheese and 300 percent for butter) are essential to maintain the price levels, as it insulates the market from international competition.[7] International dairy exporters with much more efficient modes of production, such as Australia and New Zealand, would be able to sell their products well below the administered price set by Canada’s marketing boards, making the first two pillars obsolete.

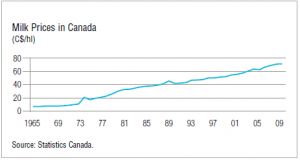

It can be argued that dairy supply management has been very successful in meeting its primary goals of price stability and fair returns for farmers.[8] However, this is only the case if you equate stability with augmentation. Since 1965, Canadian dairy price increases have outpaced international market price (see Figures 1 & 3), unlike the comparable cases of the US, Australia, and New Zealand, who, after liberalising their supply management regimes in the 1980s and 90s, saw their prices plateau in line with the international farm gate price.[9]

Figure 1. Canadian Dairy Price Trend – C$/Hectolitre

Source: Conference Board of Canada, 2012

Socioeconomic and political effects of dairy supply management

Although dairy prices have become reliably predictable in Canada, it comes with unfair consumer sacrifice. When evaluated on grounds of equity and fairness, supply management does not pass the test, as it virtually redistributes the milk production costs of inefficient farms from dairy farmers to consumers.[10] Moreover, the system can be considered unfair vis-à-vis other agricultural sectors who do not enjoy the protections the dairy sector does. In terms of the system’s effect on trade negotiations, supply management has not only historically caused, but continues to cause problems for Canada, the TPP being no exception.[11] Lastly, the supply management system impedes Canada’s ability to enter the dairy export market. Global dairy demand is growing at consistently high rates, particularly in Asia, and Canada’s dairy farmers are missing out at a particularly opportune time.

Cost to Consumers

The basic economic theory behind marketing boards (See Figure 2) is that by restricting supply (ie moving from Q1 to Q2) the price is pushed up to and maintained at the P2 level over time, thus achieving price and income stability for farmers at their distinct advantage.[12] Of course, this is only effective if the market is insulated from foreign competitors.

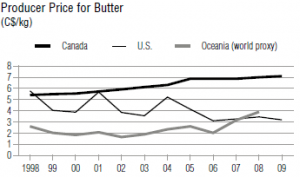

There are a number of recent studies confirming these theoretical predictions in the case of Canada’s dairy sector.[13] A notable 2009 Conference Board of Canada study comparing the prices of Canadian dairy prices with those in the US, Australia, and New Zealand found that “the minimum Canadian producer price is consistently two or three times higher than the world reference price…as well, even with the US market’s own distortions, the minimum Canadian price has been double the US price in recent years.”[14] While the US does not have a completely free dairy market like Australia or New Zealand, it is considerably less regulated than Canada, resulting in striking price differences[15] (see Figure 3).

Figure 2. Economics of Supply Control

Source: Sarlo and Martin, 2012

Figure 3. Butter Prices in Canada, U.S., Australia, and New Zealand

Source: Goldfarb, D., 2009

Supply management has been proven to raise the price of dairy foods above those in a free, competitive market, such as Australia or New Zealand. But which groups in Canada does this affect the most? Drawing from Government of Canada data on Canadian consumer spending patterns in 2008, low-income Canadians (those earning less that CAD20,000 per year) spend nearly a quarter of their total income on food. In contrast, middle and high-income Canadians spend only 5-10% of their earnings on food. A low-income family, therefore, is hit especially hard by higher food prices, especially for staple foods such as eggs and milk.[16]

Where is this money going? The protected market is meant to, and has been successful at, “providing a living income for farmers.”[17] However, Canadian census statistics show that Canadian dairy farmers are, on average, much better off financially than the average non-farming household. Average farm incomes from 2006-2010 were roughly CAD98,000, versus CAD89,000 for families in general. Perhaps a better measure is the average net worth of Canadian farms, CAD1.7 million in 2012, compared to CAD364,000 for the average non-farm family.[18]

Preferential Treatment

The support system in place for Canadian dairy farmers and the government’s staunch defense of the system in international trade negotiations reflects negatively on other agricultural sectors in two ways: (1) the unequal treatment of price supports and import protection that are not enjoyed by other sectors, and (2) defending closed dairy markets restricts international market access for other sectors since negotiating counterparts are unwilling to trade access for non-access. The ability for Canada’s export-oriented agricultural sectors, such as beef, pork, and grains, to obtain foreign market access is undermined by Canada’s unwillingness to concede access to its supply managed sectors.[19] Other countries rightly ask why they should allow unfettered access to their markets for Canadian exporters when Canada refuses to budge in supply managed industries.[20]

A prime example is the freshly concluded Comprehensive Economic and Trade Agreement (CETA) with the EU. While Canada was seeking to secure market access for its beef and pork producers, the EU Ambassador to Canada, Matthias Brinkmann, simply responded “There will be no beef without dairy. It’s almost a foregone conclusion.”[21] The negotiations, which lasted almost two years beyond expectations, concluded with Canada receiving only a limited beef export quota at a tariff-free rate, 65,000 tonnes. This was all the EU was willing to offer in return for extremely limited dairy access of just 29,000 tonnes of cheese.[22]

International Trade Implications: Shackling Canadian Dairy Farmers

Over the last few decades, Canada has entered into many large trade agreements, such as the North American Free Trade Agreement (NAFTA), the Canada-Korea Free Trade Agreement, and the historic CETA. In each case the Canadian dairy industry has come away relatively unscathed. As was the case in the CETA agreement, the liberalisation that has occurred has involved the conversion of import quotas to prohibitively high tariffs with limited preferential access at lower tariffs.[23]

Because of this approach, Canada should be considered lucky that they have even been granted a seat at the TPP negotiation table. When Canada first expressed interest in joining the TPP in August 2010, it was rejected due to its supply management system. In the following 2011 Asia Pacific Conference, Canada again faced considerable push back, this time from traditional free trade allies, Australia and New Zealand, who cited supply management as their reasons for opposing entry.[24]

The irony in Canada’s insistence to defend its roughly 13,000 dairy farmers over the wellbeing of consumers and nearly all other Canadian export industries seeking foreign market access is that the policy effectively cuts off dairy farmers themselves from “a burgeoning world demand for dairy products.”[25] As depicted in Figure 4, increasing demand and trade are expected to define the global dairy markets in the next decade, with demand outpacing supply in most geographic locations.

Figure 4. Fonterra Global Dairy Supply and Demand Projections to 2020

Source: Fonterra – https://www.fonterra.com/nz/en/Financial/Global+Dairy+Industry

Rather than seeking a path towards claiming a cut of the export pie themselves, the Dairy Farmers of Canada (DFC) continue to hold true to their stance, stating in their 2014 submission to The House of Commons Standing Committee on International Trade that:

“We should not take for granted nor forget the importance of Canada’s domestic market and make sure it will continue to be a prosperous marketplace for Canadian farmers. For dairy, essentially 100% of our sales take place in the Canadian market. Exports represent roughly 1% of Canada’s milk production and export opportunities are virtually nil…DFC is on record as supporting the Canadian government entering the TPP trade talks as a part of the government’s trade agenda that is based on the balanced trade negotiating position. For dairy farmers this means that the government will continue to defend supply management both domestically and internationally. DFC is vehemently opposed to conceding to any additional access or any over quota tariff reductions to the US or to any other TPP partners. To do so would severely undermine the Canadian dairy supply management system and result in significant losses for Canadian dairy farmers.”[26]

The fact is that the non-existent export opportunities for Canadian dairy farmers are a work of their own doing, through their own, and the Government of Canada’s, support for supply management. In 1999, the US and New Zealand issued a complaint that Canada exported dairy through “special milk export classes” (ie through export subsidies). The WTO decided to rule in favour of the US and New Zealand, preventing Canada from exporting dairy above subsidised export levels, which today accounts for roughly 1% of Canada’s milk production.[27] Canada tried to reform its dairy export system in the wake of the decision, but the changes were so miniscule that it lost its subsequent appeal and is still subject to WTO subsidised export limits.

Even if Canada were not subject to WTO export limits, the cost for farmers of buying quota to sell milk to the marketing boards and expand their production capacity is outrageously high. The minimum quota price, for the right to produce one kilogram of butterfat per day, is over CAD28,000.[28] This is an extra cost on top of the price of the livestock, land, machinery, etc. Just a decade ago, the average was CAD16,000.[29] When supply management was first implemented, that quota was free.

If Canada were to take meaningful steps towards reforming supply management in the direction of market liberalisation, as those outlined in more detail in the next section, Canada would be able to make a meaningful appeal of its WTO sanctions and be a significant player in global dairy markets with opportunities for expansion. International dairy exports have grown by more than 7 percent per year from 2010-2013.[30] New Zealand is the world’s most significant dairy exporter, accounting for over a quarter of the global dairy trade, and exporting nearly 97 percent of its milk production.[31] In the late 1980s, New Zealand went through a temporarily painful liberalisation of its dairy industry, abandoning its marketing boards, opening up to foreign competition, and forcing efficiency gains and innovation. Canada, with equitable technical expertise and better geographical access to large consumer markets (most notably the US), has no excuse as to why it could not achieve similar success.

The Trans-Pacific Partnership as a catalyst for reform

Welcoming dairy imports at low tariff levels from TPP participating countries, particularly Australia, New Zealand, and the US – three of the world’s most efficient dairy producers – would mean lower retail prices for Canadian families. Given Canada’s historically tough stance on supply management, other industries would also likely draw benefits from greater market access as allowing dairy imports would draw a high value trade-off from TPP counterparts in other industry sectors. However, the domestic political realities of supply management, and the reform process it would need to undergo to be fair to both consumers and Canadian dairy farmers, must also be carefully considered. As noted by the Conference Board of Canada, moving to free trade conditions while maintaining control over supply and prices represents an “impossible trinity” detrimental to Canada’s dairy producers.[32] A realistic reform proposal would need not only to address trade barriers but also quotas and price setting simultaneously. The three recommendations below follow this outline and offer a comprehensive reform framework centred on the TPP negotiations.

TPP Negotiations as an Opportunity to Initiate Reform

Implementing dairy supply management reform in conjunction with the TPP negotiations would be beneficial for two main reasons. First, by entering into binding commitments internationally, the time-credibility of the reform process with Canada’s dairy farmers is significantly increased.[33] That is, if the government were to try to implement reform without the international commitment, it would be much more politically convenient to succumb to the pressures of the dairy lobby and re-visit the reform when the implementation period arrived. Because of commitments made by the government in the TPP, it would reduce the credibility of anti-reform lobbies, as the reform process would not only be subject to domestic influence but to international commitment. Therefore, Canada should commit to opening its dairy markets to foreign competition in the TPP by lowering tariffs in intervals that coincide with the necessary domestic adjustments to price administration, quota systems, and the restructuring of farms themselves to meet efficiency standards necessary for international competition.

The second reason for supply management reform to coincide with an international agreement, particularly one of the size and scale of the TPP, is the potential gain for other sectors via the trade-offs given by negotiating partners for open dairy access. Moreover, allowing dairy imports would open the opportunity to negotiate for market access for future Canadian dairy exports, particularly to the Asian and Latin American TPP members, and to the world in the longer term.

If foreign competition is allowed entry, Canadian dairy farmers will only be able to thrive if they can expand internationally as domestic market share would inevitably be penetrated by foreign firms, especially given the efficiency adjustment period that will be required to meet international pricing standards. Consumers will no doubt benefit from border liberalisation but it could be at a cost of severe exits from the domestic dairy sector if the adjustment period is not managed correctly by both producers and policymakers. With this in mind, reform cannot be viewed as a zero-sum game between Canadian consumers and producers.[34] Given that among Canada’s dairy farms are some of the most technologically and managerially advanced in the world, Canada does indeed enjoy the capacity to compete internationally and gain a modest share of the export market.[35] This means that in the long run, reform would not only benefit consumers’ wallets but give Canadian dairy farmers the opportunity to expand beyond the limits of the domestic market. A staged reform process with public adjustment assistance measures for farmers would supply dairy producers with the necessary tools to make the required adaptations. Such an approach has indeed been successful in a land not too different from Canada, a land down under.

The Australian liberalisation model

The Australian liberalisation experience of the 1980s and 1990s demonstrated how a supply-controlled dairy regime could be successfully opened to the international market with limited growing pains for domestic producers. Australia implemented a supply management system in the 1920s for reasons very similar to Canada – supply and pricing consistency, farmer welfare, and protection from international market volatility.[36] However, like in Canada today, the Hawke government recognised that the policy was affecting international trade negotiations and consumer welfare, and decided the dairy industry should face international market realities.

Australia addressed its quota and price support system via two major reforms. The first was the phase out of domestic production quotas by initially allowing them to be tradable between farmers. Farms with room for expansion were able to acquire quota from those with limited capacity.[37] This allowed farms that were already internationally competitive to take advantage of the export market and uncompetitive farms to either innovate or develop other products while being compensated through the quota trade market. When the phase out was completed in 2001, 45% of Australian producers expanded cattle herds, 27% received additional non-agricultural compensation, while others modernised equipment or transitioned to other areas of agricultural production.[38]

The second major reform was the Australian government’s Transitional Assistance Program financed by a dairy levy on consumers to help ease the pain of the elimination of price supports and financed exports.[39] Because of the transition from artificially high prices supported by marketing boards and quotas to international market prices, consumers would have seen considerable decline in dairy prices. However, the Australian government applied a temporary levy on retail dairy products so that consumers saw only a small decline in the short term, but realised sizable, permanent decreases in the long term.[40] This levy was used to finance the AUD1.75 billion program aiding producers experiencing the most difficulty adjusting to the new price levels.

A solution has been proposed by both the Conference Board of Canada and Margaret Hall-Findlay which combines these two reforms by administering a book-value buyout of existing quota which is funded by a retail dairy levy.[41] A book-value buyout of existing quota means eliminating from the calculations those who have already realised enough economic rent via higher dairy prices to pay off their initial quota costs. The Conference Board of Canada concluded that such a book-value buyout would cost between CAD3.6 to 4.7 billion, rather than the oft-cited CAD20 billion-plus estimate for a market value buyout (average quota price x existing quota in force).[42] Such a solution is fair to both consumers and farmers as it realises long term retail price reductions for consumers while assisting quota holders who have yet to see their economic rents transferred to them by the previously inflated prices.[43] While having to pay a levy in the short term, Canadian consumers will still see a net benefit from lower prices.

Conclusion

The time is now for the Government of Canada to take action on dairy supply management. The Trans-Pacific Partnership offers a valuable opportunity to liberalise a sector that has unfairly taxed ordinary Canadians for decades, while lining the pockets of those better off. Dairy supply management is a solution to the old problem of non-existent export markets. Opening the Canadian border to a free flow of dairy products will not only achieve lower prices for Canadian consumers but also open a world of export growth opportunities for Canadian dairy farmers. Canada’s negotiating position in the TPP and other trade arenas continues to be weakened by the insistent defense of supply management, causing trade-reliant industries to settle for less than optimal market access outcomes. These industries deserve a fair position, consumers deserve fair market prices, and the dairy farmers of Canada deserve the opportunity to embrace international growth.

Matthew Jerke is a Master of International Relations graduate of Melbourne University.

[1] Kristelle Audet, Liberalization’s Last Frontier: Canada’s Food Trade. (Ottawa, ON: The Conference Board of Canada, July 2013), pg. 20

[2] OECD, “Producer and Consumer Support Estimates Database.” Accessed April 28, 2014: http://www.oecd.org/canada/producerandconsumersupportestimatesdatabase.html

[3] OECD-FAO. OECD-FAO Agricultural Outlook 2013–2022, Highlights. Retrieved from: http://www.oecd.org/site/oecd-faoagriculturaloutlook/highlights-2013-EN.pdf

[4] Christopher Sarlo and Larry Martin, The Economic Implications of Agricultural Supply Management in Canada. (Ottawa, ON: The MacDonald-Laurier Institute, June 2012), pg. 8

[5] James Rude and Henry An, “Trans-Pacific Partnership: Implications for the Canadian Industrial Dairy Sector,” Canadian Public Policy, Vol. 39, No. 3 (September 2013), pg. 394

[6] Rude and An, “Trans-Pacific Partnership: Implications for the Canadian Industrial Dairy Sector,” pg. 395

[7] Martha Hall Findlay, Supply Management: Problems, Politics, and Possibilities. The School of Public Policy Research Papers. (Calgary, AB: University of Calgary, 2012), pg. 4.

[8] Hall Findlay, Supply Management: Problems, Politics, and Possibilities, pg. 4.

[9] R. Allen Mussell, Bob Seguin, and Janalee Sweetland, Canada’s Supply Managed Dairy Policy: How Do We Compare? (Ottawa, ON: Conference Board of Canada, 2012), pg. 13.

[10] Michael Grant et al., Reforming Dairy Supply Management: The Case for Growth, (Ottawa, ON: Conference Board of Canada, March 2014), pg. 12.

[11] Hall Findlay, Supply Management: Problems, Politics, and Possibilities, pg. 4.

[12] Sarlo and Martin, The Economic Implications of Agricultural Supply Management in Canada, pg. 10.

[13] C.D. Howe Institute, 2009; Montreal Economic Institute 2005; Goldfarb, D, 2009.

[14] Goldfarb, Making Milk, pg. 13.

[15] Danielle Goldfarb, Making Milk: The Practices, Players, and Pressures Behind Dairy Supply Management. (Ottawa, ON: The Conference Board of Canada, November 2009), pg. 12.

[16] Sarlo and Martin, The Economic Implications of Agricultural Supply Management in Canada, pg. 13.

[17] Bruce Muirhead, “The Trans Pacific Partnership: Implications for Supply Management and the Canadian Dairy Industry,” WCDS Advances in Dairy Technology (2013) Vol. 25, pg. 121.

[18] Sarlo and Martin, The Economic Implications of Agricultural Supply Management in Canada, pg. 15.

[19] Goldfarb, Making Milk, pg. 23.

[20] Hall Findlay, Supply Management: Problems, Politics, and Possibilities, pg. 12.

[21] Janyce McGregor, “Canada-EU trade talks tee up tough political choices,” CBC News. November 2012.

[22] CBC. “CETA: Canada-EU trade deal by the numbers,” CBC News. October 2013 http://www.cbc.ca/news/politics/ceta-canada-eu-trade-deal-by-the-numbers-1.2125473

[23] Rude and An, “Trans-Pacific Partnership: Implications for the Canadian Industrial Dairy Sector,” pg. 394.

[24] Ian Lee, Canada’s Trade Opportunities at Risk from Supply Management. (Ottawa, ON: The MacDonald-Laurier Institute, June 2012), pg. 23.

[25] Grant et al., Reforming Dairy Supply Management, pg. IV.

[26] Dairy Farmers of Canada, Trans-Pacific Partnership Agreement: Presentation to the House of Commons Standing Committee on International Trade. (Ottawa, On, 2013), pg. 3.

[27] R. Allan Mussell, The WTO Dairy Export Decision: What Next For Growth in the Canadian Dairy Industry? (Ottawa, ON: The George Morris Centre, March 2003), pg. 4.

[28] Goldfarb, Making Milk, pg. 20.

[29] Goldfarb, Making Milk, pg. 20.

[30] Grant et al., Reforming Dairy Supply Management, pg. IV.

[31] Grant et al., Reforming Dairy Supply Management, pg. IV.

[32] Grant et al., Reforming Dairy Supply Management, pg. IV.

[33] World Trade Organization, World Trade Report 2007: Six Decades of Multilateral Trade Cooperation – What Have We Learnt? (WTO, 2007), pg. 59.

[34] Grant et al., Reforming Dairy Supply Management, pg. 100.

[35] Grant et al., Reforming Dairy Supply Management, pg. 50.

[36] Hall Findlay, Supply Management: Problems, Politics, and Possibilities, pg. 15.

[37] Mussell, Seguin, and Sweetland, Canada’s Supply Managed Dairy Policy: How Do We Compare?, pg. 7.

[38] Valentin Petkantchin, Reforming Dairy Supply Management in Canada: The Australian

Example (Montreal, QC: The Montreal Economic Institute, January 2006), pg. 3.

[39] Petkantchin, Reforming Dairy Supply Management in Canada: The Australian Example, pg. 3.

[40] Grant et al., Reforming Dairy Supply Management, pg. 102.

[41] Grant et al., 2014; Hall Findlay, 2013

[42] Barrie McKenna, “Cost of ending dairy quotas much smaller than expected: study,” The Globe and Mail. Retrieved from: http://www.theglobeandmail.com/report-on-business/cost-of-ending-dairy-quotas-much-smaller-than-expected-study/article17123557/

[43] Grant et al., Reforming Dairy Supply Management, pg. 101.