QE: Outsourcing Responsibility

In the context of the global financial crisis central banks have successfully taken on larger responsibilities deploying unconventional tools to stabilise markets and pump money into the economy. Perhaps they should do more.

Quantitative Easing (QE) is a subject guaranteed never to get you a good time at a party. The terminology alone is enough to make the listener’s eyes glaze over and head to the nearest bar. However, what it represents and the issues involved may have greater consequence over time than is currently realised. It could represent a template for governments to outsource greater responsibility to non-elected technocrats.

The Concept

QE is the concept whereby a central bank attempts to stimulate an economy by crediting its own account and purchasing bonds with that credit. This drives up the price for bonds making companies, hedge funds and others invest somewhere else where they may get a greater return on their investment. The aim is spur demand in other areas of the economy which hopefully will lead to more jobs. Central banks only get to this level of desperation when interest rates, their traditional weapon of choice, are effectively at 0% or cannot go any lower.

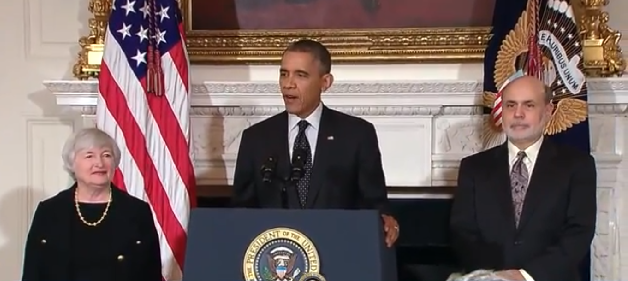

In the United States the purpose behind the program has transitioned from stabilising the economy to being implemented, in what was described as a ‘watershed moment’) with a particular goal in mind: reducing the unemployment rate. In this respect, at least for the United States, it remains popular: it only cost a couple of trillion (figure of speech: according to the concept it doesn’t really cost anything but just increases the proportion of high-liquidity assets in the system) and is still going despite in early 2013 the then Federal Reserve Chairman Bernanke warning QE would be halted by end of year. It’s hard to stop a good thing.

Not all countries take such a light view of the unconventional tactics deployed. QE has the side-effect of devaluing the US dollar (the global reserve in which most global trade is conducted) making exports more expensive for other countries and running the potential risk of a currency war. It decreases the yield for foreign investors (Japan and China have more than a trillion dollars in US bonds) and thus has an effect of capital flows, especially in emerging markets.

The concept has caught on in Japan, which had a version of QE from 2002-2007, while Britain brought in a Canadian to further its QE program. The European Central Bank has said it will do “whatever it takes” to save the euro, but for the time being has relied upon traditional bail-out provisions. Whether it is a success or not (every economist seems to have a different opinion) the use of unconventional tools such as QE has proliferated.

Give Them a Mandate

So is this an argument for technocrats? Certainly one of the more successful European governments was run by an unelected technocrat. The Italian government of Mario Monti, who stabilised the Italian economy, implemented reforms widely seen as encouraging for economic growth yet failed dismally at the first election he contested. Lucas Papademos, a well-qualified technocrat, served as Greece’s Prime Minister helping the country restructure its debt and avoid a default.

However the risk is that governments can relax and avoid tough economic reform in the knowledge that central banks will pick up the slack. It decreases the incentive for governments to take politically unacceptable but much-needed reforms.

The equilibrium between getting what electorates want (via populist politicians) and effective economic policy (unelected bean-counters) should be re-calibrated, not drastically but incrementally, towards technocrats. Ruthless suppression and absence of individual rights aside, it is no accident that China has been able to lift millions from subsistence to middle class lifestyles. Likewise Singapore with its rules-based one-party rule has provided ‘the best advertisement for technocracy.’ The democratic model of governance should have the ability to learn from other governance models and adapt.

The mandate for central banks should be expanded, particularly in Europe where governments seem unwilling to spend the political capital required for reform. Expanding the power of the US Federal Reserve is impossible in the current context of US politics but perhaps its mandate is, on a de-facto basis, already changing given its increasing focus on unemployment.

Unconventional actions by non-elected technocrats were once considered bold and new. Further economic responsibility should be outsourced to them in one form or another.

Patrick Hill is an intern at the AIIA National Office. He has a degree in Law and International Relations from Griffith University and is currently pursuing post-graduate studies in International Security Studies.