Is it Time to Push Back Against China’s Economic Statecraft?

China’s hold over large enterprises allows it to manipulate Chinese companies to align with state interests. It gives China the rare ability to use economic power as an instrument of statecraft. Australia and others must learn to respond effectively.

It is well established that Beijing not only believes that economic power is an integral part of what Chinese theorists call ‘‘comprehensive national power’, but that it also can and should be used as an instrument of statecraft.

The People’s Republic is not alone in thinking this way. States have long tried to use commercial and financial parties to pursue foreign policy objectives, with variable results. Economic statecraft—the manipulation of those parties to further state interests—is difficult to practice because of the principal-agent problem it generates. The interests of governments and firms do not always align, making it hard to get private actors, in particular, to do what political leaders would like them to do.

In China’s case, however, some argue that the nature of the party-state and the existence of large and powerful state-owned enterprises in key industries make it easier for Beijing to get around the principal-agent problem. In this way, Chinese state capitalism is begetting new and stronger forms of economic statecraft.

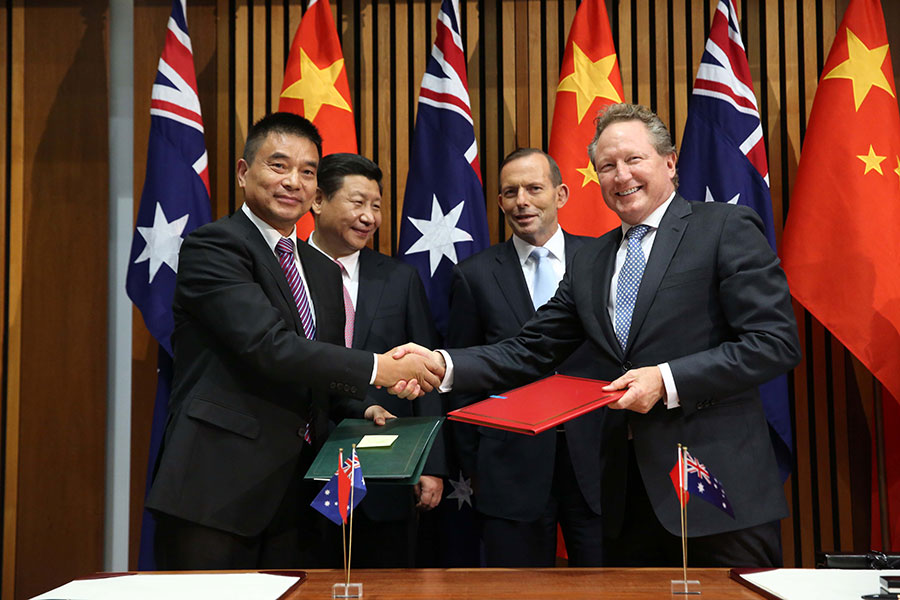

To be sure, Beijing is using large aid packages, loans, investment deals, infrastructure projects and commercial contracts, as well as market access, to pursue its foreign and security policy objectives. It is also deploying considerable resources to public relations, seeking to sell these deals to foreign publics as examples of what can be achieved when their governments, corporations, universities and other actors engage with China.

The Belt and Road Initiative (BRI) is the greatest example of this turn to PR, gathering up many already existing projects with extravagant promises of further benefits to be delivered if states agree to a win-win cooperation with Beijing. It downplays the considerable risks for vulnerable states in engaging in large-scale borrowing from Chinese banks for schemes overwhelmingly to the benefit of Chinese firms and labour.

Economic statecraft is not, in any case, just about carrots. It also involves the wielding of sticks to dissuade states and other actors from doing things one does not want, or to punish them when they stray. These might take the form of punitive tariffs or regulatory burdens, but they can also involve arms-length sanctions, like carefully orchestrated, supposedly spontaneous consumer boycotts. And they can have big effects: as James Reilly notes, studies have shown that just hosting a meeting with the Dalai Lama can lead to a big drop in trade with China.

Australia has not yet faced a full-scale attempt by Beijing to wield a stick, despite being a major beneficiary of China’s post-Cold War economic development. It came close in 2009, as Bates Gill and Linda Jakobson note, when the Defence White Paper singled out the People’s Republic as a national security threat and then-Prime Minister Kevin Rudd criticised its human rights record. Rio Tinto took some of the punishment then, with executive Stern Hu imprisoned for supposedly stealing commercial secrets and accepting bribes.

Much has obviously changed since 2009, as China has grown more assertive and more prone to use a variety of means to assert and protect its expanding interests. And although bilateral trade remains strong, other aspects of the Australia-China relationship have grown more challenging. Particularly problematic is Beijing’s attempt to influence Australian politics through campaign donations to existing politicians and lucrative jobs for retired ones, as well as the use of Chinese language media and social groups, including on university campuses, to shape opinion in Chinese-origin or overseas Chinese communities.

Canberra’s robust public response to these efforts, combined with other moves, including involvement in the revived Quad (Australia, US, India and Japan), has angered Beijing. The latter’s full response will likely take some time to evolve, but it is significant that one of the earliest moves has been against Australian universities. Education is, of course, Australia’s third biggest export industry, with some 170,000 Chinese students enrolled in universities and other institutions in 2017.

After a series of reports in state-run media outlets criticising the Australian higher education sector, the Chinese Foreign Ministry has now issued safety warnings for students intending to study in Australia, extending those put out earlier by its Canberra embassy. Threats have also been made about possible consumer-led boycotts of Australian products by Chinese consumers, along the lines of previous campaigns against goods from Japan, South Korea and the Philippines.

Managing these threats and the costs they may impose will be difficult for all concerned. But is worth observing that, as Reilly and others argue, economic coercion is often expensive to the party wielding the stick and mostly counterproductive. In China’s case, its attempts to punish its regional neighbours for perceived slights and supposed disregard for its claims have led to backlashes, shifts in government policy and corporate disengagement from the Chinese market.

Importantly, Beijing also appears to recognise that economic coercion is risky. As Darren Lim and Victor Ferguson noted last year, the Chinese government is careful to impose sanctions in ways that minimise the effects on production networks in which Chinese workers play a role. That might be cold comfort for Australian universities, should they face a full-scale boycott sometime soon, but it suggests that Canberra has leverage in other areas of the economic relationship that could be used to push back.

And push back Canberra should, when the time comes. At stake here is not simply the economic interests of a sector of the Australian economy. What China’s economic statecraft threatens is more than that: the continuance of the open, non-discriminatory trading system that has greatly benefited the region over several decades. Replacing that system with a Sino-centric alternative in which Beijing decides who gets access to its market according to whether it approves of a state’s foreign policy choices is clearly not in Australia’s national interest.

Ian Hall is a professor of international relations at Griffith University. He is also a member of the Griffith Asia Institute and an academic fellow of the Australia India Institute.

This article is an edited version of a paper presented at the Australia-India-Japan Trilateral at the Griffith Asia Institute on Monday 5 February. It is edited and republished with permission.