Following the Money: How Transparent are the World's International Organisations?

International organisations such as the World Bank and the International Monetary Fund lead the global push for state budget accountability but a new study suggests such organisations may need to begin improving their own transparency.

Fiscal transparency is at the core of public policymaking and citizen involvement, as budgets determine how public revenues will be collected and used. Enabling public scrutiny of budget processes, policymaking and policy implementation emerged as an important development indicator for both developed and developing states in the late 1990s. These efforts were formalised via the IMF and OECD transparency codes. The codes provided guidance for member-states looking to implement fiscal transparency. The International Budget Partnership has also helped to encourage state-level budget transparency through its biennial Open Budget Survey since 2006. However, although there have been projects focused on bilateral and multilateral donor project transparency for international organisations (IOs), our recent study is the only one to evaluate the organisation-level budgets and transparency of these groups.

The budget transparency questionnaire

The effort to measure IO budget transparency is based on our unique 93-item questionnaire. The questionnaire has four sections: budget process; budget disclosures; financial management and accountability; and organisational information. State-level questions were modified to reflect IO characteristics and multiple IO-specific questions, such as member-state contributions, were added. The importance of readily available historical budgetary and financial statements were also emphasised.

The questionnaire was applied to three IOs: the World Bank, the OECD and the United Nations Development Programme (UNDP). The results show that the World Bank has the greatest overall transparency (53.8 per cent), followed by the UNDP (45.2 per cent) and the OECD (41.5 per cent), where 100 per cent indicates a fully transparent budget. The OECD is most transparent in its budget process, but least transparent for the specific budget documents. All three IOs generally do not score well for budget disclosures (below 40 per cent) and part of that result is explained by the study’s emphasis on historical disclosures. On the other hand, the three IOs score relatively well on the financial management and accountability items, except for historical disclosures.

Opaque budgeting

Overall, the results suggest that IO budget transparency is lacking. Not only are the aggregate transparency scores inadequate given the influence of the three IOs in encouraging fiscal transparency among their member-states, but also it was surprisingly difficult to find key information on either their websites or other publicly available documents. This is in sharp contrast to national-level transparency efforts and expectations, at least in the United States, for multiple disclosures by states and local governments.

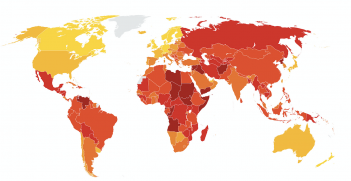

The global governance implications of our findings are significant, both for the global community and for Australia. While Australia was not one of the nearly 100 countries that had its fiscal transparency evaluated by the International Budget Partnership in 2015, key Australian allies such as New Zealand, the US, the UK and South Korea were evaluated. New Zealand’s score of 88/100 (where 100 means full budget transparency) earned the top mark. The US was fifth (81/100), the UK was eighth (75/100) and South Korea was 19th (65/100).

The situation in Australia

Despite Australia not being included in the Open Budget Survey, fiscal and budget transparency are important topics. Operation Sunlight (2008) aimed to increase budget transparency across government ministries and departments. Earlier statements such as the Charter of Budget Honesty (1998), written shortly after the IMF drafted its first Fiscal Transparency Code for its member-states, also encouraged fiscal transparency. Recent developments such as a Joint Select Committee on the Parliamentary Budget Office have boosted fiscal policy research relevant to parliamentary roles and responsibilities. While the Department of Foreign Affairs and Trade (DFAT) has stated its commitment to increased aid transparency, this commitment has not been articulated for other areas of Australian foreign affairs, including its interaction with regional and international organisations. While the DFAT website specifies Australian IO involvement, detailed interactions exist only for those IOs where Australian interest appears greatest. It is even difficult to find a list of regional and international organisations to which Australia belongs and which are partly funded by Australian tax dollars. This may increase the impression that Australia’s transparency interests remain narrowly defined.

Yet middle power countries like Australia have important, perhaps even linchpin, roles within our global governance arena. This includes the encouragement of IO budget transparency. It was not too long ago that Australia worked with the ‘like-minded’ group of states to help create the International Criminal Court, contrary to the wishes of global hegemons such as the US, China and Russia. Australia’s recently released Foreign Policy White Paper suggests, “the principles of good governance, transparency and accountability” matter.

On closer inspection, however, Australia appears to have been more interested in encouraging transparent bilateral relationships and protecting the transparency of its national institutions from foreign interference. Transparency is an outward-focused effort rather than an Australian objective for the regional and international organisations that it helps fund.

While IOs are part of a disaggregated and loosely institutionalised global governance system, middle power states can plant the seed from which transparency blossoms. The creation of constitutive agreements (such as rules or processes) that encourage budget transparency may be an initial step forward. Australia has experience influencing IO behaviours, policies and projects via its use of trust funds, its provision of additional voluntary contributions or even a threat by former Treasurer Joe Hockey to “examine alternative options” if the US failed to increase the vote share (and voice) of countries such as Brazil, Korea, China and India.

In the past Australia has been unafraid to engage in global governance and to challenge its foundations when needed. This is a trait initiated by former minister for foreign affairs Herbert Evatt’s comments at the 1945 San Francisco conference where delegates from 46 states helped create the United Nations. Evatt’s concern about Security Council vetoes (and ability to create alliances with similarly aggrieved Latin American states) led Evatt to be called “the most frightful man in the world” by UK diplomat Alexander Cadogan.

Despite a legally defined sovereign equality for each IO member-state, states are not equally powerful and one-for-one representation doesn’t align with domestic expectations. The pressures faced by Australian parliamentarians from both the market and citizen advocacy to create transparent fiscal environments has not been put forward within IOs. The study indicates that three of the most important international organisations, each with a strong focus on fiscal transparency in their member-states, are perpetrators of a ‘do as I say, not as I do’ fiscal stance. This stance should be a concern for all Australians whose taxes help fund the country’s involvement within these and other organisations.

Dr Kim Moloney is a senior lecturer in global public administration and public policy at Murdoch University.

Dr Rayna Stoycheva is a lecturer in public administration at the University of Miami.

This article is published under a Creative Commons Licence and may be republished with attribution.