Electing the World's Banker

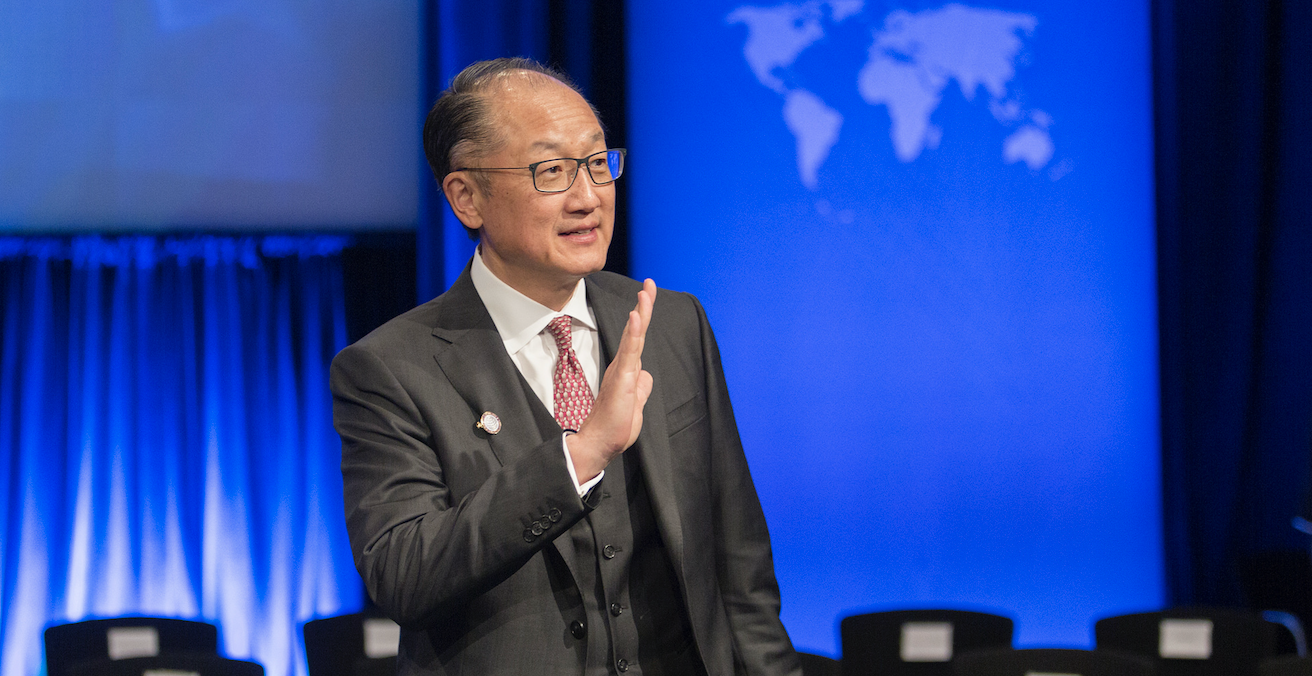

The resignation of World Bank President Dr Jim Kim has triggered controversy over who should replace him. It also raises questions about the Bank’s role in addressing problems of poverty and inequality in international development.

The president of the World Bank, Dr Jim Kim, suddenly resigned from his position on 6 January 2019. While Kim is not the first World Bank president to resign, he was not even halfway through a second five-year term. He had been endorsed a second time by the Bank’s 25-member board of executive directors, which represents all 189-member states, in 2016. His early departure surprised the international community, immediately igniting fierce debate over what this portends for the World Bank. Concerns hinged on two matters: the role of the World Bank in addressing problems of poverty and inequality in international development, and whether another US appointee will be elected to the top job – now determined by a US president scornful of multilateralism.

First, in his resignation letter, Kim identified that he could better meet the Bank’s goals for ending extreme poverty by 2030 and aiming to improve prosperity for the bottom 40 percent of people in developing countries by operating in the private sector as opposed to the World Bank – the world’s premier multilateral institution. Kim took up the offer to work for Global Infrastructure Partners, a private-sector investment fund. Symbolically, this undermines the very need for a multilateral institution to promote development and tackle global poverty, despite the fact that the World Bank is an essential vehicle for states to channel development finance. Indeed, the OECD recognises that multilateral-development lenders have expertise in mobilising resources, have specialist knowledge in infrastructure and financial services, are a means for collective action in development matters and can deliver global public goods.

The World Bank has ramped up lending to developing countries over the last two decades. Committing over US $47 billion in financial year 2018 in loans and credits (including its International Development Association funds), the World Bank remains the premier source of development assistance globally. Kim jumping ship signals that the primary advocate for the World Bank’s role in international development financing does not believe it can do what needs to be done to address key international problems such as facilitating infrastructure, of which there is a significant gap. To take advantage of the massive flows of private-sector investment in the early 2000s, the World Bank shifted its focus to facilitate such investment by working more closely with its private-sector lender, the International Finance Corporation. Operating as a more integrated World Bank Group (including IFC and the Multilateral Investment Guarantee Agency that provides political risk insurance) enabled the constellation of organisations to lend nearly US $64 billion in 2018.

The prevailing consensus is that public money is no match for addressing global poverty and inequality, and only harnessing private investment can provide the solution. The current US administration goes further: opposing multilateralism by trying to cut World Bank funding to the bone. Despite this, Kim was a vociferous champion of using private-sector finance for international development in conjunction with the World Bank and was able to actually gain a US $13 billion capital increase for Bank operations from its member states in 2018, a substantial increase not seen since the aftermath of the Global Financial Crisis.

Kim’s departure, therefore, raises the question as to who will replace him. This is the second key problem for the Bank. As is commonly known, there is a gentleman’s agreement that the head of the World Bank will be an American, with a European leading the International Monetary Fund. This means the United States selects a field of candidates it would approve, for the Bank’s board to consider. However, rumblings for an open competition for the post emerged after the dramatic resignation of Bank President Paul Wolfowitz in 2007, when it was revealed that he had given preferential treatment a staff member with whom he was in a romantic relationship.

However, it was not until 2011 that changes to the nomination process emerged, with specific criteria for selection and a method for polling candidates. Kim’s first appointment under President Barack Obama in 2012 was challenged by the first outright “competition” for the job when a field of candidates from other countries including Colombian Jose Antonio Ocampo and Nigerian economist Ngozi Okonjo-Iweala were put forward. The race was mounted by states seeking to challenge the dominance of the United States in determining how an international organisation, to which they all contribute (on a one-dollar, one vote basis), should be led. In the end, Kim’s nomination pacified member states with the appointment of an Asian-American physician with first-hand experience of development to the position, in line with the new criteria. With Kim now gone, there is another bid by other states for a non-American president, although the entrenched anti-multilateralist stance of President Trump has dampened the likelihood of it working.

Can the United States be stared down? No. The reason why it is likely for a US candidate to be president is that the United States has informal influence within the Bank as well as formal voting power (controlling 16.88 percent of the vote in the Bank, which gives it the power to veto decisions that require a super-majority to pass). The US will not countenance losing power over the ability to determine who runs the Bank and could threaten to withdraw should it not get its way. As the World Bank remains dependent on US funds for capital replenishment, this is a battle the Bank does not need. Effort must be saved for securing capital replenishments to operate and ensure the smooth functioning of the Bank. Given the general level of US distrust for multilateralism, this requires a president with diplomatic skills and knowledge of the US government. Since the late 1960s, World Bank presidents have hired former members of US Congress to advise them on how to negotiate with Congress, which has the power to reject payments of the US contributions to the World Bank.

Previous Bank presidents have hewn from Congress (Barber Conable 1986-1991), within US government (Robert Zoellick 2005-2007) and private investment banks (James Wolfensohn 1995-2005). The United States recently tapped David Malpass, the Department of Treasury’s undersecretary for international affairs (and former chief economist of the defunct Bear Stearn investment bank) as their nominee over Pepsico CEO Indra Nooyi and the US Overseas Private Investment Corporation president Ray Washburne, among others. Malpass has knowledge of the Bank, and worked to pass the last capital replenishment for the Bank, but is an outspoken critic of the organisation and a Trump loyalist with questionable diplomatic skills. The implications for choosing a president ill-equipped for the role is that they could either alienate the rank-and-file staff of the Bank, as Kim did during his tumultuous reorganisation, or contribute to the demise of the Bank through antagonising middle-income borrowers like China and India, on which the Bank depends in order to finance development globally. For now, the Bank remains in the capable hands of its interim President Kristalina Georgieva.

Susan Park is an associate professor in International Relations at the University of Sydney, teaching International Organisations. She examines how actors influence the Multilateral Development Banks (MDBs) to become greener and more accountable. Her new book is International Organisations and Global Problems: Theories and Explanations (Cambridge University Press, 2018).

This article is published under a Creative Commons License and may be republished with attribution.