Conflicting Perceptions of the AIIB

The Asian Infrastructure Investment Bank highlights the fundamental conflict at the heart of how China is viewed by much of the world. On the one hand the AIIB is the result of global calls for China to play a bigger global role, but on the other it has been met with resistance and accusations of power politics. Where China sees the AIIB as a way of rebalancing an unfair global system, the US sees a calculated move to disregard the norms of modern global institutions.

In June, the Asian Infrastructure Investment Bank (AIIB) held its inaugural meeting in Beijing, bringing together representatives from its 57 founding members. It is a key initiative of China’s ambitious One Belt, One Road project and the bank aims to address Asia’s enormous infrastructure needs whilst simultaneously contributing to the current system of global governance.

These dual purposes of the AIIB can complicate perceptions of its actions. This is illustrated by suspicions generated by the bank’s recently approved investment in Myanmar.

The AIIB has been widely described as a challenge to the traditional Bretton Woods institutions such as the IMF and World Bank. Its creation came alongside that of the BRICS New Development Bank in 2015, and speaks to a broader trend of dissatisfaction among rising world powers about the current state of international institutions.

What the AIIB does give is a greater voice to those nations who feel they have been relegated to punching below their weight in the current system. While not yet ready to dwarf the World Bank, or even the Asian Development Bank (ADB), the AIIB has serious potential to redefine global economic clout.

The bank’s existence highlights the growing tension within the current balance of global governance, one that benefits the US and limits China’s voice. This frustration is not misplaced. Part of the problem arises from how the IMF calculates its quotas for voting, with “economic variability” and “openness” representing 45 per cent of the weighting.

In 2015, the BRICS nations condemned the unequal voting shares inside the IMF and declared the need for international institutions to become more reflective of 21st century economic power. Previous attempts to reform voting rights in the IMF began in 2010, but were stalled for years by the US congress. Developing market economies have grown frustrated with this system that does not represent them equitably in the main organs of global governance.

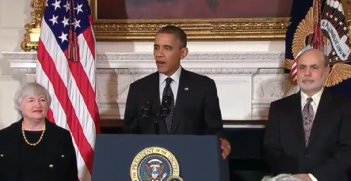

US President Barack Obama has raised opposition to the AIIB (despite claiming that was never the case) and argued that China will steer the conditions on its loans to meet political objectives in the region. The US sees the AIIB as a financial rival that will undermine the leverage afforded to the US through their dominance in the World Bank. It has also been argued that the AIIB exists to support Chinese political expansion across the region, such as in Myanmar.

Similarly, Japan has sided with the US in a bid to protect their supremacy in the Asian Development Bank and curb China’s financial power. Traditional Bretton Woods institutions have put a focus on anti-corruption in their lending packages with investment generally aimed at also increasing political and economic freedom around the world. The AIIB has thus far stayed clear of tying a political agenda to its loans, yet that is precisely what has fuelled doubts about its true purpose in the region.

Myanmar poses an interesting test case for the many concerns raised about the AIIB. While the recent approval of a new power plant is being financed by the AIIB alongside the ADB and World Bank, it has been approached with the same suspicion that has plagued the AIIB more broadly. Existing Chinese state-financed projects make further Chinese involvement in Myanmar a concern for the international community.

While Myanmar will likely see massive benefits from increased Chinese investment, the international reaction highlights the crux of US and Japanese opposition to the AIIB. China’s role in financing investment seems inextricably linked to fears of Chinese neocolonialism and regional hegemony. The AIIB’s involvement in Myanmar will be key in assessing how concerns about the AIIB eventuate or dissipate as its involvement across the region grows.

It is temptingly easy to see the AIIB as a calculated power play from Beijing, but that belies the justifiable extent of China’s frustrations with existing global institutions and China’s role in addressing regional issues. Furthermore, it is disingenuous to pass off the AIIB as a way of simply absorbing Chinese overproduction, or characterise it as nothing more than a boldfaced power play to challenge existing institutions.

With 57 other countries involved in the financing of the AIIB’s projects under its open procurement policy, there is very little to suggest the AIIB will be the solution to China’s overproduction issues. Additionally, three of the bank’s inaugural projects are being co-financed by the World Bank, the ADB and the European Bank for Reconstruction and Development.

With the IMF recently adding the Chinese Yuan to its reserve currency basket, it is important not to mistake simple recognition of China’s economic significance as the result of power politics. For years the US and others have called for China to take a more prominent role on the world stage. We shouldn’t blame China for wanting a stage that has room for them.

Cormac Power is an international relations and economics student at the University of Western Australia.

This article is published under a Creative Commons Licence and may be republished with attribution.